For new entrants to the market, success in Japan relies on an up-to-date and in-depth understanding of who your audience is so you can make a call on how to adjust your branding in Japan. This may require an overhaul of what you’re doing in other markets or smaller changes.

Drawing from on-the-ground experience from our Tokyo office, here’s our guide on adapting Western brands for Japanese audiences.

Table of Contents

- An introduction to recent changes in Japanese consumer behavior

- What role does branding play in the Japanese market

- The challenges of adapting Western brands for Japan

- Understanding the Japanese consumer in 2023

- Ways to optimize your branding in Japan

- Important Japanese branding takeaways

- Steal some of our best ideas!

An Introduction to Recent Changes in Japanese Consumer Behavior

The landscape in the Japanese market is always changing, with consumer preferences leading the charge. For example, the willingness to pay high prices for luxury products from recognizable Western brands (while still significant) is not as strong as some companies might hope, with consumers now presenting a higher level of price consciousness.

Whether it’s the influence of globalization, the economy, digitization, maturing consumer tastes, climate change or Covid-19, Japan’s middle class has become increasingly complex and segmented, with individual groups driven by a number of different motivators.

For new entrants to the market, success here relies on an up-to-date and in-depth understanding of who your audience is so you can make a call on how to adjust your branding in Japan, whether this requires an overhaul or simply a slight adjustment of what you’re doing in other markets.

What Role Does Branding Play in the Japanese Market

Though less individualistic or egotistical than consumers in other markets, you could say that many people in Japan long for quiet recognition and there’s no doubt that the brands people buy play a big part in helping them achieve this.

Contrary to the situation in many Western countries, individualism and standing out too far from the crowd is often a bad thing. And many shoppers are reluctant to purchase from companies that have not been widely vetted by society and subsequently deemed worthy.

Japanese consumers have often been described as incredibly sensitive to the way brands contribute to someone’s public image, which is especially noticeable in the apparel market (the fourth largest globally after the US, China and India).

Even for customers who avoid flashy luxury brands and prefer companies that promote minimalism and utilitarian designs, like the incredibly popular Muji (which actually means “no brand” in Japanese), there is clearly a conscious effort by consumers to tap into a specific image being created by this brand.

Some Western brands only succeed after several years of building credibility and strengthening their reputation in the eyes of consumers before they are “accepted”.

This can take considerable investment, but is often necessary to sway people into seeing you as a brand that will support their image and position in society—something that is incredibly important in a culture where collectivism and peer acceptance are so important.

HB Pro Tip: A useful exercise worth trying is imagining how long it would take a Japanese brand name in your sector to break into your home market and achieve the same amount of success you’re planning to achieve in Japan. Then, consider how much investment this would take. Similar to Western consumers, there will naturally be a lack of trust and hesitancy for any foreign brand until it has gathered a decent reputation for itself through targeted brand awareness initiatives.

The Challenges of Adapting Western Brands for Japan

No brand should expect to immediately inhabit the same position in the Japanese market as they do at home (no matter how popular they are). You might get to where you want eventually, but you could face a great deal of resistance from Japanese competitors who are already established here.

Some wrongly assume Japanese society has been heavily “Westernized”, with its obvious appreciation of imported brands from America and Europe, but the truth is that Japanese consumers will generally opt for domestically manufactured products from recognized brand names, rather than ones from abroad.

There is also the sense that “we can do it better” among Japanese brands who, rather than adopting foreign concepts in their totality, regularly choose to adapt. Many local companies are focused on creating a more “Japanese version” of a foreign product (something that happens across all parts of Japanese society from fashion to food).

Brands that have been successful in growing a local consumer base, from KFC to New Balance, have typically had to work hard on localizing their products and services—adapting the way they do things to better suit Japanese consumers, or at the very least, refreshing their approach to local marketing and advertising.

Advertising in Tokyo? Read Our Checklist for Japan’s Fastest Moving Consumer Market!

What Motivates Japanese Consumers to Buy Western Products in 2023?

It’s important to understand the few reasons why the average Japanese consumer will choose Western brands over Japanese ones.

- A brand is trending and the general public and influencers are showing it love

- Items are not available from domestic brands

- Brands are imported from a country famous for doing something really well, such as coffee from Colombia, wine from France or cars from Germany

- Items are less expensive from foreign manufacturers (something that more often applies to Chinese made products rather than Western products)

- The brand is considered to be “exotic” and promotes a certain lifestyle that people want to be part of (e.g. sustainable outdoor fashion)

Identify and Leverage Your Western Appeal

We’ve seen countless brands leverage their US origins heavily in their Japanese branding and marketing. For instance, L.L. Bean, whose sales have recently dwindled in the United States have seen continued growth in Japan thanks to its ability to project itself as a provider of high quality, reliable and classic outdoor gear.

Interestingly, we’ve seen an increase in the popularity of Nordic brands from Denmark, Norway, Sweden, Finland, and Iceland in recent years.

One of the best success stories is of course IKEA, who have positioned themselves as solution providers to the common Japanese problem of fitting furniture into small apartments.

As part of its Tiny Homes campaign, IKEA Japan debuted a fully furnished 10sqm tiny apartment in the city’s Shinjuku district (notorious for its lack of space).

The brand’s campaign helped to draw out elements of Scandinavian design that customers would find the most appealing and relatable, such as the ability to create interior spaces that are both affordable and highly functional without appearing cold or characterless.

Want to Know If Japanese Customers Care About Sustainability?

Phase Out Any Weaknesses in Your Brand

A weakness could be the way your products are packaged to your actual brand or product name. For instance, the way English words sound in Japanese can seem strange, for lack of a better word. Or, in the worst cases, they can actually be offensive or rude.

The same thing happens when Japanese companies launch their products in Europe or the US. For instance, the company you probably know as Toyota is actually widely known as Toyoda in its home country, while Lays or Walkers crisps are known as Frito Lay.

Great Examples of Western Brand Localization for the Japanese Market

Many brands have failed to find the kind of success they hoped for in the Japanese market, however, many have done so well that their profits here have vastly outpaced those made at home.

Toys R Us, for instance, still enjoys impressive popularity in the Japanese toy market while their prominence has since diminished globally. Below are a few of our favorite examples of successful brand localization.

Red Bull/Red Bull Racing

The Japanese energy drinks market is huge with revenue estimated to increase from 5.9 billion USD to almost 6.9 billion USD by 2027.

It is also highly competitive and the majority of market share is held by key players like The Coca-Cola Company, Otsuka Pharmaceutical Co. Ltd (the producer of the popular Pocari Sweat electrolyte drink) and Red Bull.

The popularity and success of the Red Bull brand in Japan has no doubt been supported by their involvement in Formula 1 and the growing popularity of F1 in APAC, with Japan remaining a key market for the world’s top racing series.

Investments in localized brand campaigns and marketing continue to increase the relevance of the brand among its broad demographic base, leveraging Japanese models, scenes, design and of course, Japanese manga as featured in their Red Bull Race Day ad campaign below.

Although there has been a shift towards lower caffeine and more health conscious drinks in recent years, energy drinks and specifically canned drinks are still one of the most preferred and highly consumed beverages in Japan—partly owing to their widespread availability and convenience for people with long working schedules and hectic lifestyles.

Head & Shoulders

Animation is a category convention breaking approach, aimed to stand out from traditional product-focused shampoo commercials. animation allows for which heightens both the action and humor of the film.

Head & Shoulders, the anti-dandruff shampoo brand of Procter & Gamble, has released a new animated campaign for its Japanese market, narrating a tale of espionage of dandruff prevention. Entitled ‘The Chase’, the campaign follows Ando the spy as he is being chased by Detective Takashi and his henchmen across the world.

Talking about dandruff among men in Japan is met with a taboo factor, they aimed to create the campaign to uplift a humorous element to it, as well with a theme of action-packed sequences.

Godiva

Japan has one of the biggest chocolate markets in the world and consumers spend more than $500 million on chocolate on Valentine’s Day each year alone. This has spurred many chocolate brands to take their products here, but only a few have achieved the kind of success that Godiva has.

The brand now has over 250 outlines in Japan, located across department stores, high end supermarkets, and stations, offering its wide selection of cookies, biscuits, and ice cream.

This is partly thanks to highly localized marketing efforts and an adjustment of their overall branding in Japan to make their products both aspirational and accessible to the average Japanese shopper.

Promotions (such as the one above) based on important gift giving seasons, creative advertising tapping into the motivations of Japanese audiences, the use of manga in ad creative, and leveraging the appeal of Belgium’s reputation as a producer of fine chocolate have all helped Godiva to do well here.

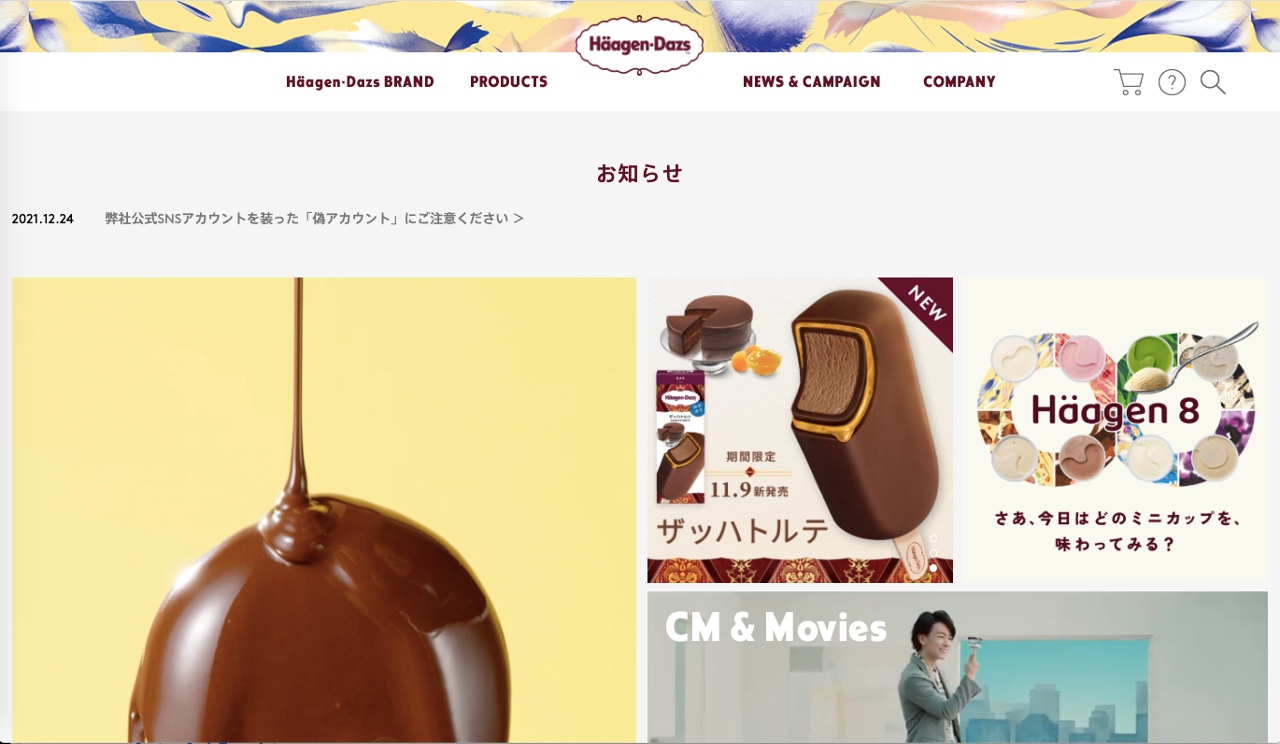

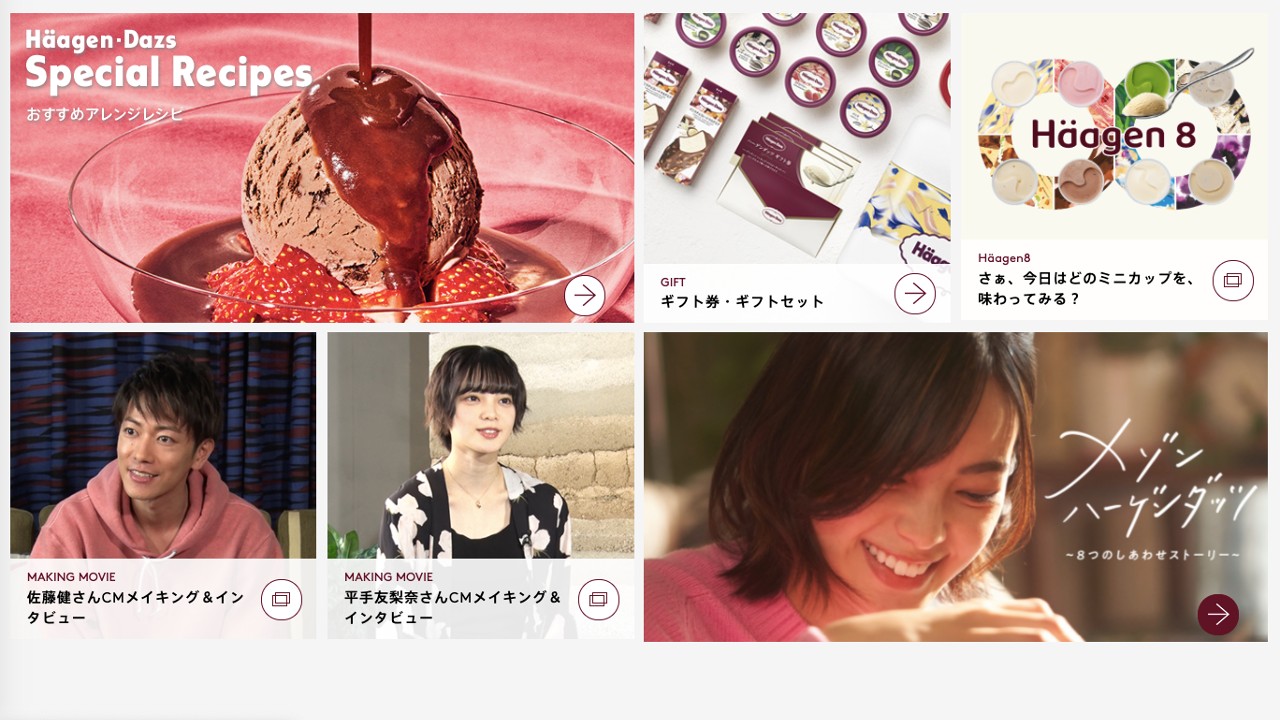

Haagen Dazs

Did you know Häagen-Dazs sells more than thirty flavors of ice cream that are unique to Japan? Using a classic tactic among Western brands selling drinks, foods and confectionery items, this American ice cream company has done incredibly well at tailoring its products to the taste of real Japanese customers with flavours including Hana Mochi Kinako Kuromitsu (mochi with soybean powder and brown sugar syrup) and Murasaki Imo (purple sweet potato).

The brand also launched their now globally popular ice cream sandwich right here in Japan. This “Crispy Sandwich” combined limited edition flavours with a whole new snack format that placed ice cream within two slices of biscuitty goodness.

Want to Know More About Common Approaches to Advertising Design in Japan?

Understanding the Japanese Consumer in 2023

Performing your own analysis into Japanese consumers within your sector is the best way to understand how your branding in Japan should be adapted. However, below are a few generalizations that can be taken with a pinch of salt.

Read Our Guide on How to Perform Effective Japanese Market Analysis

Japanese Cultural Tendencies

Cultures that are less individualistic and avoid uncertainty are harder to win over with new brands, hence the need to invest heavily in brand building strategies when you first enter the Japanese market.

A higher long-term orientation score also adds difficulty to your task (implying greater loyalty to brands), makes it harder to tempt customers away from companies they have potentially been buying from for several years before you arrived on the scene.

| Uncertainty Avoidance | 92 |

| Power Distance | 54 |

| Individualism | 46 |

| Masculinity | 95 |

| Long Term Orientation | 88 |

| Indulgence | 42 |

Source: Hofstede Insights Country Comparisons 2023

HB Pro Tip: Japanese customers have been characterized as exceptionally loyal to brands and service providers compared to consumers in other nations. If companies can maintain good relations with customers in Japan, it will be much harder for new entrants to tempt them away, even when competitor brands offer similar (or better) products at a lower cost.

What Do Japanese Consumers Like Buying Online?

| Product Type | % of Shoppers |

| Groceries | 31 |

| Electronics | 24 |

| Beauty & personal care | 19 |

| Clothing/shoes | 18 |

| Household products | 14 |

| Luxury | 12 |

| Alcohol | 10 |

| Home & furniture | 10 |

| Medicine & healthcare | 9 |

| Financial products | 9 |

Source: GWI

Distrust in Institutions

Japanese people are incredibly distrustful of institutions according to indicators like the Edelman Trust Barometer. When it comes to businesses, NGOs, media and government, the nation is among the three least trusting nations globally.

Although more open to marketing and advertising content in general than other developed nations (as long as it’s engaging and presented in a way that offers value), it’s only through peer reviews and public consensus that many brands achieve acceptance.

Collectivism & Homogeneity

Japan is one of the most homogeneous nations in the world, which is truly surprising for many who believe it to be as cosmopolitan as other leading economies.

For brands, it’s important to recognise that individuals in a collectivist culture may make certain decisions differently to those in a more individualistic culture where wanting to stand out and be different is more common.

In societies where people are more group-oriented, consumers will look for brands that are more widely accepted by their peers and establish their position in society, rather than ones that make people question their identity.

HB Pro Tip: Many individuals are not prepared to be the first-mover. Reviews, ratings, comparison sites, and recommendations from friends are fundamental to the buying process for Japanese shoppers, helping them to feel more confident about their purchasing choice.

Quality Conscious

Some have attributed Japan’s love for premium and luxury products to the simple desire for higher quality goods that are more durable and long-lasting. Others believe this drive is largely thanks to the notorious lack of space in cities like Tokyo or Osaka, where people buy less goods overall, but want these products to be “better” (quality over quantity).

This also translates to presentation. Appearance and form are highly valued in Japanese society and the way your brand/product looks and feels will have a huge impact on whether someone believes it to be of good enough quality to buy.

HB Pro Tip: There’s perhaps no country in the world where poor quality can damage your reputation so quickly and so much. Everything from inconsistencies in your online customer experience or defects with your actual product can contribute to a poor brand reputation.

Advertising in Tokyo? Here’s Our Checklist for Japan’s Fastest Moving Consumer Market

Age Demographics

Brands must be cautious when targeting only younger consumers with expensive products, even if you’ve built your name on targeting a very well defined group so far (e.g. athletic apparel for yoga-loving millennials).

If your brand lacks suitability for the middle aged or seniors, you’re limiting yourself to a much smaller group of consumers (due to Japan’s rapidly aging population) than you would be in other markets.

Another major consideration is that older Japanese people naturally have much more disposable income than younger. And profits might only be possible for Western brands by adapting their key target demographics, products and overall branding in Japan to be more appealing to slightly older Japanese citizens.

Due to a low birth rate and high longevity, people aged 65 years and over were estimated to make up more than 38 percent of the population in Japan by 2060. The share of children younger than 15 years old is expected to decrease to around 10 percent by the same tie.

HB Pro Tip: Due to the way seniority and workplace promotions are relative to time dedicated to a company (rather than simply because of performance and competence), Japan’s age breakdown is an incredibly important factor for brands to integrate into their local strategies.

Want to Know More About the Japanese Consumer?

Ways to Optimize Your Branding in Japan for 2023

| Product Variation | Can your product (or versions of your product) be adapted to better suit your audience. For instance, many brands from Starbucks to Pepsi have launched new flavors or themed designs that match popular Japanese seasons to drive sales and brand credibility. |

| Size and Fit | As well as potentially needing clothes that are, on average, smaller than those worn by consumers in the US, Japanese consumers, on the whole, don’t like clothes that are too revealing or tight fitting. Many clothing stores like Zara have adapted their lengths and designs to match local tastes better. |

| Color Palette | Studies suggest color preferences differ between cultures. In a study into the cross-cultural differences in color preference between Japan and the US, it was found that Japanese observers had a greater preference for light colors and pastels. |

| Product Models and Influencers | Japanese consumers are more likely to be attracted by brands that are modelled and enjoyed by Japanese people, not Western models or influencers. Whether it’s your product photography or social media content, opt for local faces and names rather than reusing your content from other markets. |

| Formality & Style | One of the most fascinating (and fun) things about being in the Japanese market is the scope you have for making your brand and marketing potentially quite silly and cute. If you didn’t already know, cuteness and silliness are common themes in advertising. |

We’ve seen design and color play a huge role in all kinds of marketing and branding related situations in Japan. For instance, when we advised one of our clients, DailyFX, to rethink their brand guidelines for the local market and introduce a more casual and colorful design approach, they were able to see an increase in Instagram followers by 30% MoM, as well as an increase in their engagement rate by 16.3% MoM!

Important Japanese Branding Takeaways for 2023

The need for strong branding in Japan is clear. The approach you take, however, will need to be tailored to your products and audiences, based on what you know about local interests and motivators. You may only need to tweak a few things to position yourself well, or, if needed, you may be forced to make a more substantial change to your core brand identity.

Finally, below are a few takeaways to keep in mind as you work on adapting your brand Japan.

- Without a localized brand strategy, it’s impossible to builds trust with customers who are naturally risk-averse and relationship-oriented

- Price and product quality aren’t always enough to win over Japanese customers — it generally takes long-term brand awareness and publicity campaigns to build connections with customers who may already have loyalty for other brands in your space

- Market research and demographic data is the best starting point for any brand localization strategy and should give you a better idea about what may or may not need adapting

Steal Our Best Ideas

Actionable insights straight from our data

Here are a couple quick discoveries we’ve pulled from the data of our latest projects. Why? To help you make the changes you need to gain traction in the Japanese market! As an agency, we are always digging deeper and searching for those little yet significant tweaks that will push our clients to the next level of success. If you need a partner to help you identify and implement changes like these on a monthly basis, let us know!