The Japanese market has changed dramatically over the past two decades, yet outdated myths surrounding what doing business here is like still persist. These range from horror stories about bewildering business practices to the idea that Japan’s corporate landscape is an impenetrable fortress where only the toughest (and richest) of companies can succeed.

While it’s true that moving into a new market like Japan isn’t a decision you should take lightly, the greatest barriers to entry can often be overcome with diligent planning, guidance from local experts, and targeted market analysis to help you move beyond preconceptions to a practical understanding of your sector.

So, if you’ve made a commitment to learning as much as you can about your Japan and want to find out more about the economy, investment climate, demographics, and consumer mindset, before you jump in, we’ve laid out some important considerations that can help your business thrive in Japan.

Why Japan Market Analysis Matters

An unpredictable adoption of global trends, a unique consumer attitude to products, rapid uptake of new technologies, and an almost endless network of potential communication and sales channels are all part and parcel when working in Japan.

There is perhaps no activity as fundamental to your success as the initial body of research you conduct. And from our experience working with dozens of foreign businesses in sectors ranging from fashion and lifestyle to aviation and property, behind every great success story is usually a history of substantial market research.

- Japanese customers can be extremely demanding with tastes that vary substantially to Western consumers. To succeed, it’s sometimes necessary for your branding, marketing communications, and even products to be adapted to show off your best side.

- Japan has a robust network of strong local companies who tend to rally against new competitors. Foreign businesses must be prepared for such competition through careful positioning and an ongoing understanding of market threats.

- A dense network of regulations, permissions, certifications, procedures, and authorities make Japan extremely bureaucratic. Navigating the necessary approvals requires a working knowledge of local systems and practices.

- Japan’s substantial size and complex infrastructure often mean extensive investments are needed upfront. With this comes greater risk and the need for you to get the process right the first time round.

HB Pro Tip: Market analysis lays the structure for your more creative activities. When aligned with accurate research and assessments of your sector, everything from your Japanese website and brand communications to your ads and social media engagement will be more impactful. This, in turn, will make customer acquisition cheaper.

Explore Our Japanese Web Development Services

A Glance at the Japanese Market

After the United States and China, Japan has the third largest economy in the world. There is strong domestic demand here and significant purchasing power among its population. It is also home to one of the fastest growing ecommerce sectors, which connects brands with millions of digitally savvy Japanese consumers.

While economic growth has been subdued in recent years and the nation faces a number of socio-economic problems, such as falling birth rates and an ageing population, its presence in the Asian market, and indeed beyond, is still formidable. This presents global brands who have sights set on further expansion an opportunity to develop a strong foothold in Asia-Pacific.

As the fourth largest importer of US products after Canada, Mexico, and China, Japan has exhibited a substantial appetite for foreign brands. Overall, the business environment is favourable for inward investment, supported by a stable political system, respect for the rule of law, strong protections for intellectual property, and increasingly accommodating policies for inbound businesses.

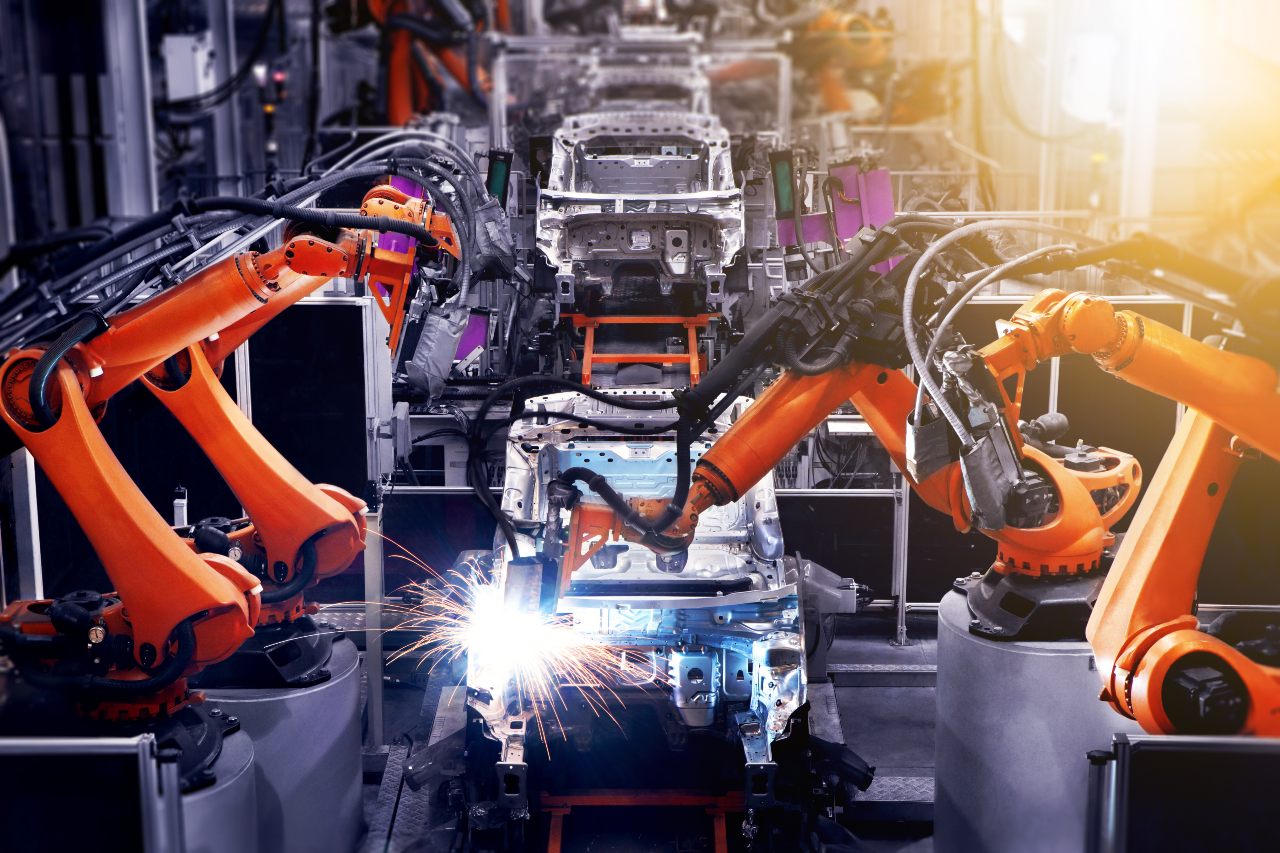

Japan is now a leader in consumer electronics; engineering; aviation; advanced technology; research and development, and car manufacturing, among other key sectors driving the economy. Influenced also by future demand from its rapidly ageing population, specific segments will continue to grow substantially.

According to Santander’s foreign investment profile for Japan, medical equipment, pharmaceutical products, biotechnology, safety equipment, and dietary supplements are among the key areas of opportunity within the national economy.

Key Sectors in Japan

| Gaming | After only China and the US, Japan has the third largest games market estimated at $18,683 million according to Newzoo. Many of the biggest (and oldest) companies in the gaming industry like Nintendo continue to thrive here. |

| Retail | Japan is the third-largest e-commerce market globally where individuals have high personal wealth. Much of the population enjoy shopping on many of the nation’s popular ecommerce platforms, such as Rakuten and Amazon Japan. |

| Automotive | Japan is still the world’s biggest producer of cars and home to the largest market for automotive parts, technology, and expertise. |

| Biotechnology and healthcare | In line with its ageing population and the maturity of its technology sector, Japan has invested heavily in healthcare related technologies in recent years. |

| Information Technology | Modern and sophisticated technology infrastructure, widespread internet penetration, a formidable gaming sector, and a love for digital media contribute to Japan’s robust IT sector. |

| Electronics | Almost a quarter of the world’s high-tech products are made in Japan, which is home to many of the world’s largest tech companies. |

| Tourism | Japan is one of the most visited destinations on the planet by tourists, and although the residing foreigner population is less than 3%, it continues to cater to millions of visitors each year. |

| Energy | The country is still one of the top primary energy consumers globally and following the 9.0 magnitude Great East Japan Earthquake, many nuclear power generators have been shut down with Japan now making substantial investments in renewable energies and other alternative sources. |

Forecasted Ecommerce Growth in Japan

Revenue in the ecommerce market is projected to reach US$104,639m in 2020 with fashion; electronics & media; toys & hobbies; furniture & appliances, and food & personal care being the most popular categories.

Revenue is expected to show an annual growth rate of 6.5% between 2020 and 2025, resulting in a projected market volume of US$143,279m by 2025. This will also be supported by a user penetration rate of 76.7%, expected to hit 91.2% by 2025, and a steady appetite for new products and technologies among Japanese households.

| Year | Revenue in million US$ |

| 2017 | 72,647 |

| 2018 | 80,729 |

| 2019 | 88,110 |

| 2020 | 104,639 |

| 2021 | 112,465 |

| 2022 | 120,292 |

| 2023 | 128,054 |

| 2024 | 135,666 |

| 2025 | 143,279 |

Source: Statista

Learn More About Ecommerce in Japan

Foreign Investment Climate

Japan is ranked 29th out of 190 countries in the World Bank’s 2020 Doing Business report, which seeks to provide objective measures about business regulations and their enforcement, within the context of how easy it is for companies to operate here.

When compared with other developed nations across the world, Foriegn Direct Investment (FDI) investment is generally low, reaching only $14,5 billion in 2019 compared to the UK’s $59 billion or Germany’s $74 billion, according to the UNCTAD’s 2020 World Investment Report. This contrasts its number one position as the largest investor in the world.

Today, Japan is actively trying to welcome new foreign businesses with a collection of policies and incentives backed by the government’s pro-global business stance.

While there is still progress to be made in this regard, with Japan still detering many would-be investors through its perceived difficulty and notoriously complex regulations, the investment climate here is considered to be favourable to foreign businesses on the whole.

FDI Overview

| Foreign Direct Investment | 2018 | 2019 |

| FDI Inward Flow (million USD) | 9,858 | 14,552 |

| FDI Stock (million USD) | 204,780 | 222,527 |

| Number of Greenfield Investments | 253 | 242 |

| Value of Greenfield Investments (million USD) | 10,983 | 8,427 |

Source: UNCTAD

Barriers to Japanese Market Entry

Some of the most common barriers to entry uncovered during the Japan market analysis process include the following:

| Japanese business practices | Unique cultural barriers and close business links between large domestic corporations. |

| High quality/standard expectations | Stringent regulations and bureaucratic practices combined with excessive quality expectations set by industry governing bodies. |

| High cost of doing business in Japan | A high entry cost and need to invest in local support to facilitate successful operation locally. |

| Preference for domestic products and brands | A love of Japanese products among consumers and an unwillingness to purchase foreign products with no existing reputation. |

Choosing Your Investment Location in Japan

Tokyo, with its over 8 million residents, remains an obvious choice for new businesses establishing their operations in Japan. As well as providing a reliable infrastructure and a burgeoning consumer population with an openness to foreign trends and brands, there is a larger ratio of high-income consumers here. It is also close to powerful central government regulatory agencies and Japan‘s highly centralized transportation networks. Other potential locations include:

- Kansai (Osaka, Kyoto etc.) – An important political and cultural hub with a diverse economic base, catering to businesses in several sectors, including food, textiles, and electronics.

- Kyushu – Sometimes known as “Silicon Island” “Car Island” “Food Island” or “Solar Island”, the area’s strengths lie primarily in its service-based businesses across finance, insurance, and real estate, centred around Fukuoka City.

- Okinawa – An especially foreigner-friendly location for US businesses looking to import goods and services, Okinawa offers a wide range of subsidies and tax incentives for investors and employers.

Top 10 Most Populous Cities in Japan

| Tokyo | 8,336,599 |

| Yokohama | 3,574,443 |

| Osaka | 2,592,413 |

| Nagoya | 2,191,279 |

| Sapporo | 1,883,027 |

| Kobe | 1,528,478 |

| Kyoto | 1,459,640 |

| Fukuoka | 1,392,289 |

| Kawasaki | 1,306,785 |

| Saitama | 1,193,350 |

Source: World Population Review

Performing Japan Market Analysis

There are several ways to carry out diligent market research that leads to intelligent insights about your sector and future customer base. These can range from acquiring in-house resources to working with third-party local market research firms or partners.

Whichever method you choose, below are some important things to keep in mind when performing Japan market analysis.

| Dig deep into business environment factors and outlook | Things change quickly in Japan. While building your body of analysis, pay attention to the changing winds that could influence your future opportunities and threats. Key factors include:

|

| Turn raw data into actionable insights | It’s easy to get lost in misleading numbers or stats. Gathering and synthesizing information about your market should always result in practical takeaways you can implement into your business plan. |

| Look for adjacent opportunities and areas to adapt | Many successful companies in Japan have pivoted in their approach after learning more through market analysis, increasing their chances of achieving profitable growth. This could include adapting your consumer targets to applying your business model to an adjacent segment. |

If you’re looking for a local team to help you with your market research activities, we work with a number of firms specialising in delivering actionable insights and market analysis for foriegn business who are new to

the landscape. Let us know and we’d be happy to put you in touch!

Getting Started in Japan – Crucial Considerations

While many companies avoid Japan due to its perceived difficulty, a unique and competitive product or service can perform incredibly well when backed by a solid market entry strategy. Below are a few requirements for any Japanese business strategy.

| Timing | First-mover status is incredibly important in Japan where markets move incredibly fast and consumers and corporations are typically loyal to their existing brands and suppliers.

Getting in early and developing the right reputation for yourself can help you fend off competition, contributing to long-term success. |

| Company Incorporation | There are a number of options when it comes to establishing your business in Japan. These range from setting up a local branch to working with a local partner who can help you with your distribution. Pay close attention to what each option offers you in terms of their inherent benefits and drawbacks. |

| Product and Content Localization | Localization does more than just help people understand what your tagline means or what your product does. Good localization will help your brand to build credibility in the market, and cater to the complex demands of Japanese consumers. |

| Bilingual Capabilities | Hiring local talent can be difficult and you may need to work with a hiring agency to get the skills you need. In certain specialisms like digital marketing, the pool of candidates is significantly smaller compared to the extensive offering of professionals working in this sector in most other developed nations. |

| Resourcing | Hiring local talent can be difficult and you may need to work with a hiring agency to get the skills you need. In certain specialisms like digital marketing, the pool of candidates is significantly smaller compared to the extensive offering of professionals working in this sector in most other developed nations. |

Learn About Your New Audience

Individuality and setting yourself apart from the crowd is a popular thread in brand marketing and advertising in the US and Europe. Offering people something that will free themselves from the “common” or “predictable” continues to be a cornerstone theme of many successful campaigns hoping to have a disruptive effect on their market.

In Japan, where collectivist thinking is prevalent, consumers are less concerned with being different than being accepted by their peers. So, by presenting yourself as too unique or unusual, you could be deterring many potential customers.

Japanese consumers are also highly risk averse and distrustful of organizations, according to indicators like the Edelman Trust Barometer. This means that establishing that initial connection with them is even more important, and can be achieved through considered marketing strategies that focus on presenting yourself in the right way, building a strong sense of your quality and reliability.

If you simply mimic your approach from your home market, there’s a huge chance you could miss out on a great many discerning Japanese customers.

HB Pro Tip: There is an extremely high expectation for quality in Japan, which carries through to many aspects of the consumer world. Customers generally prefer more information than less, and are often deterred by companies that are too “mysterious” and show too little product information in their marketing content.

Want to Know More About the Japanese Consumer Mindset?

Final Thoughts

Whether it’s accurately assessing your sector and where you should position yourself within it, or finding out the important motivations and triggers of your new target customers, success in Japan requires a strong grasp of what you’re getting yourself into, and where the major opportunities and threats lie.

The best way to make sure your investments have an impact is to build a solid foundation that removes as much guesswork as possible when it comes to understanding your market. The Japanese market can be different in many ways to what you’re used to, but diligent and targeted Japan market analysis should give you the knowledge and confidence needed to make the right decisions.